Leading diamond exploration and retailing company De Beers recently raised their prices by 8%, according to a report by Bloomberg.

De Beers raised prices of rough diamonds throughout much of 2021 as it sought to recover from the first year of the pandemic when the industry came to a near halt. Yet most of those price rises were focused on larger and more expensive diamonds, while the emphasis now is on cheaper stones.

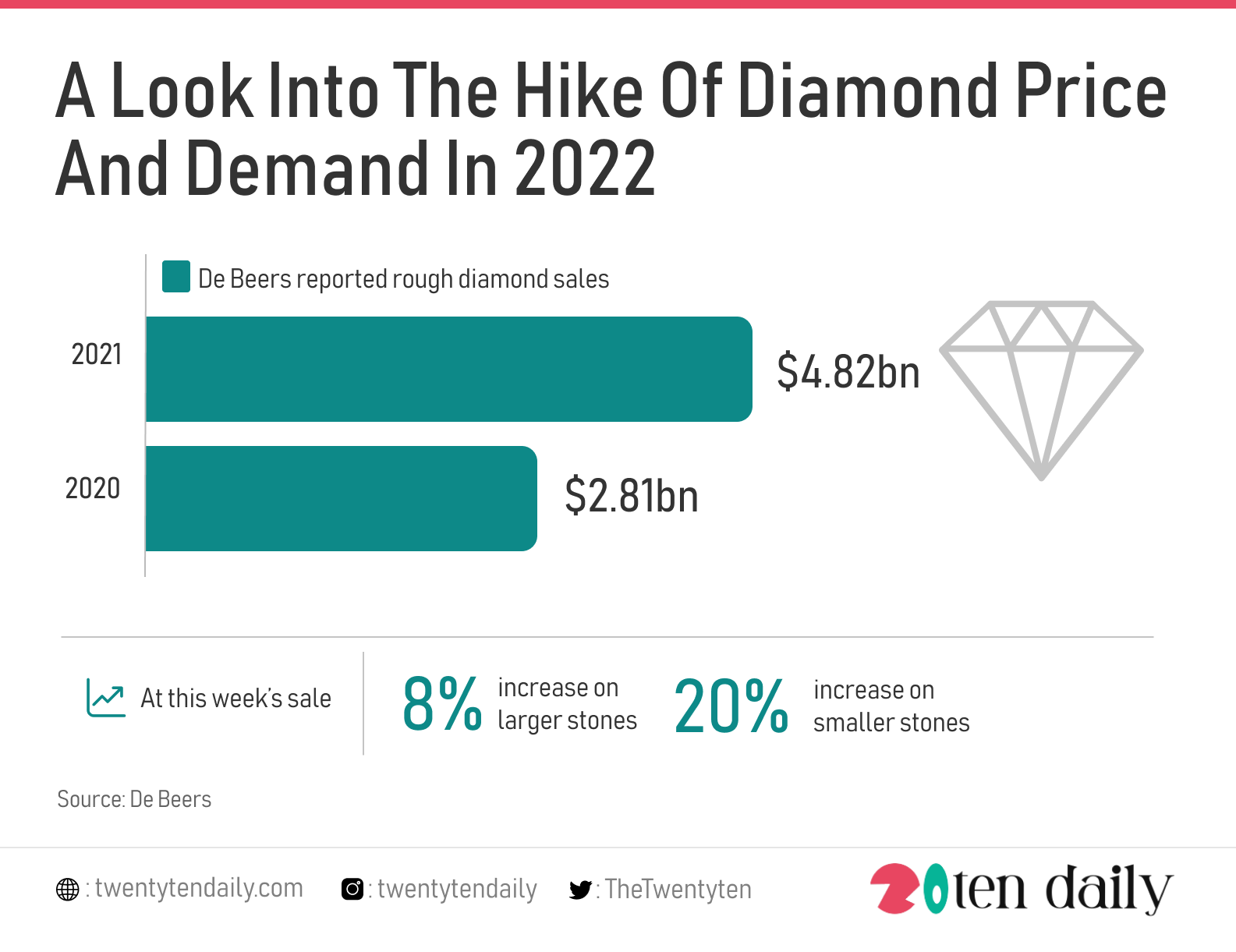

At this week’s sale in Botswana, De Beers raised the price of larger stones by about 8%, the people said, while some smaller rough diamonds saw prices hikes of as much as 20%.

The diamond retail market is said to be one of the sectors that unexpectedly rebounded quickly from the economic downtime caused by the coronavirus pandemic. Consumer demand for diamond jewellery continues to grow strongly even as supply remains constrained.

Behind The Hike In Demand Of Diamonds

A customer sentiment survey issued by Bain in 2020 showed that consumers, especially in the US and China, continue to value diamond jewellery as a desirable gift and a key element of marriage. Consumers in the US said jewellery and watches are among the top four gifts they would like to receive; consumers in China and India ranked them in the top two. In the US, China, and India, 60% to 70% of respondents believe diamonds are an essential part of a marriage engagement. After the pandemic, 75% to 80% of consumers said they intend to spend the same amount or more on diamond jewellery than they would have before the crisis. This indicates a strong, ongoing emotional connection with the diamond story.

Another factor that contributed to the diamond market growth was the strengthening of digital sales, as consumers decided to forgo the in-person shopping experience and purchase from home.

“After years of lagging behind most other consumer products, online jewellery sales picked up at once, and even small independents benefited from this surge in demand,” said Edahn Golan, founder of Edahn Golan Diamond Research and Data.

“As a result, retailers’ inventories started to deplete, creating shortages and price increases during the year,” he added.

As Rapaport’s Avi Krawitz noted during a December market presentation, the sector also saw what he described as the “emotional gifting” of diamond jewellery in 2021. “Some people wanted to express their love for loved ones through a gift, and what better gift than jewellery?” Krawitz said during the webinar. “There may be a conditioning of emotional gifting that people had during COVID, and that’s continued.”

De Beers was one of the top beneficiaries of the hike in demand. De Beers reported rough diamond sales of US$4.82 billion in 2021, a 41 percent uptick from the 2020s US$2.81 billion. This trend (to a smaller extent) was echoed among many other miners.