Data obtained from the National Pension Commission has shown that the assets under the Contributory Pension Scheme rose by N120bn in August 2021.

PenCom, in its latest unaudited report on pension funds industry portfolio said the assets rose from N12.78tn at the end of July to N12.9tn in August.

PenCom also revealed that the total Retirement Savings Accounts rose slightly from 9,405,553 in July to 9,427,003 at the end of August.

The operators invested N8.29tn of the funds in Federal Government’s securities, while the rest was invested in other portfolios such as domestic and foreign ordinary shares, corporate debt securities, local money market and mutual funds.

18,525 workers disengaged

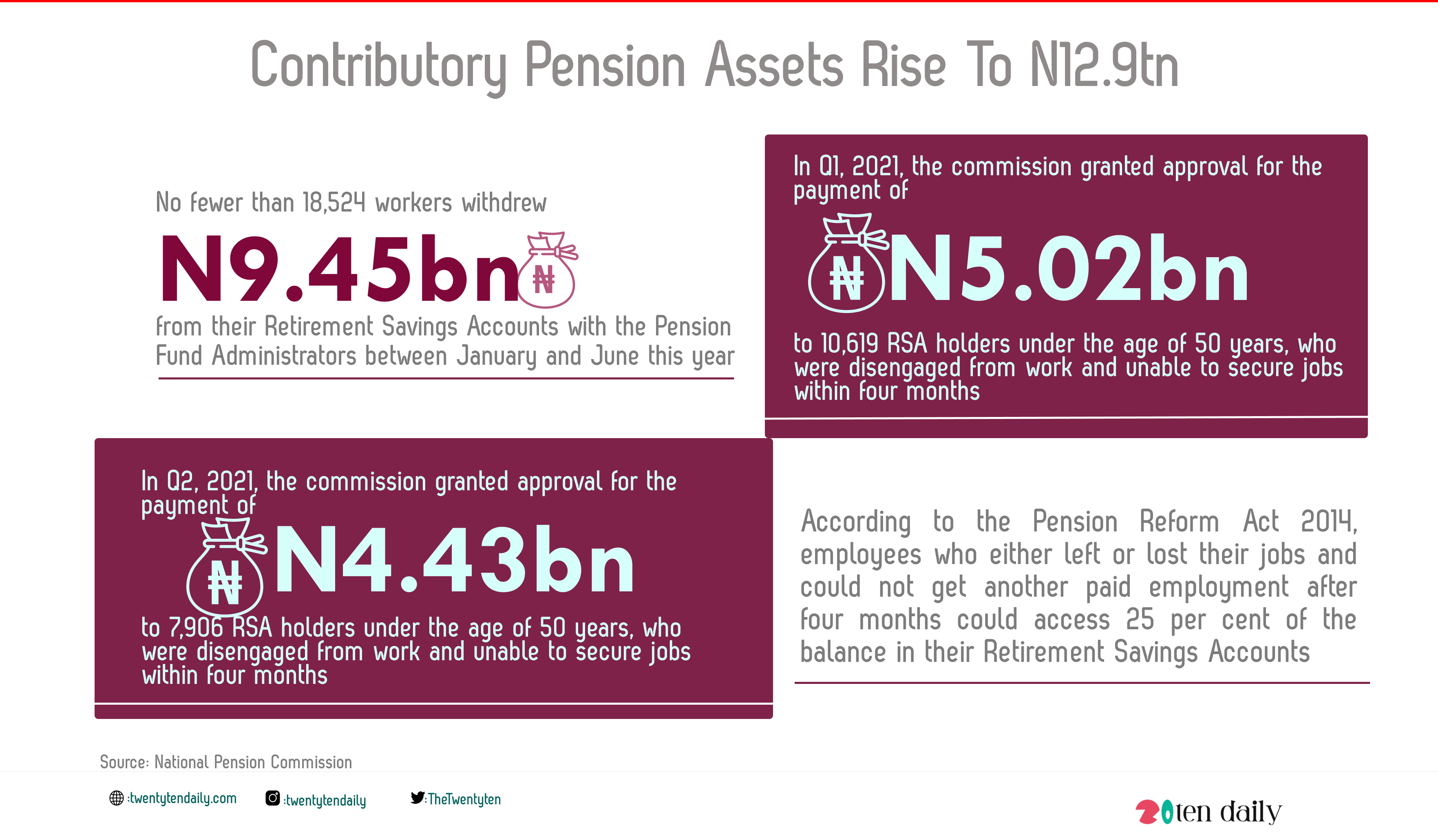

No fewer than 18,524 disengaged workers withdrew N9.45bn from their Retirement Savings Accounts with the Pension Fund Administrators between January and June this year.

PenCom revealed this in its quarterly report titled, ‘Withdrawal due to temporary loss of employment.’

The report revealed that during the first quarter of 2021, “The commission granted approval for the payment of N5.02bn to 10,619 RSA holders under the age of 50 years, who were disengaged from work and unable to secure jobs within four months.

It added that in the second quarter of the year, “The commission approved the payment of N4.43bn to 7,906 RSA holders under the age of 50 years, who were disengaged from work and unable to secure jobs within four months.”

According to the Pension Reform Act 2014, employees who either left or lost their jobs and could not get another paid employment after four months could access 25 per cent of the balance in their Retirement Savings Accounts.