Oil price has continued to climb as demand recovers faster than was predicted. The global benchmark Brent is up at nearly $80 a barrel, its highest price since October 2018.

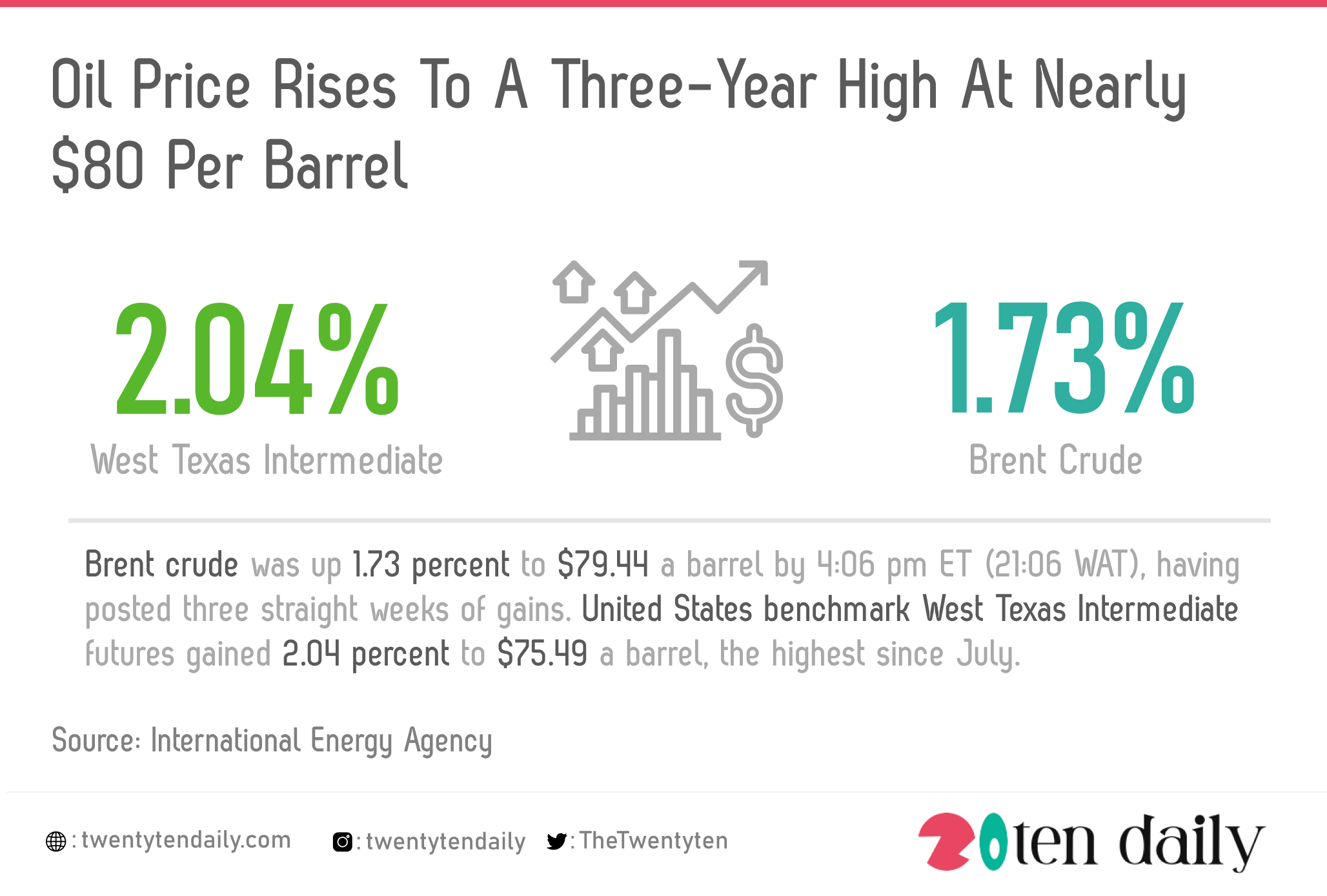

Brent crude was up 1.73 percent to $79.44 a barrel by 4:06 pm ET (21:06 WAT), having posted three straight weeks of gains. United States benchmark West Texas Intermediate futures gained 2.04 percent to $75.49 a barrel, the highest since July.

The current rally has caused Goldman Sachs analysts to boost the bank’s year-end forecast for Brent from $80 to $90 per barrel. In a note to investors on Monday, Goldman said the current global oil supply-demand deficit is larger than it had initially expected.

Oil prices collapsed in April 2020 as the coronavirus pandemic halted global economic activity and decimated demand for crude. But the rollback of pandemic restrictions this year, along with business reopenings and climbing vaccination rates, has spawned a recovery in global crude demand.

The economic recovery, however, is not the only reason for the current crude rally.

Bloomberg reports that the Organization of the Petroleum Exporting Countries and its allies (OPEC+) had tightened supply when the pandemic first hit and prices plummeted. Having lifted those prices out of the abyss, they agreed to slowly loosen the taps and allow more barrels to hit the global market.

According to the International Energy Agency (IEA), the world consumed 99.7 million barrels per day (BPD) of oil in 2019, before the COVID-19 pandemic collapsed fuel demand. As the global economy recovers, the IEA predicts that crude demand will return to pre-pandemic levels sometime next year.

“We’re likely to see immediate price growth continue as a follow-on to the ongoing natural gas supply crunch in European markets and the slower-than-hoped reintroduction of US production affected by Hurricane Ida,” Blakemore told Al Jazeera.

“Even with OPEC expected to loosen supply restrictions by another 400,000 barrels next week, we may be only seeing the beginning of a more significant price rally over the next few weeks/month as concerns about the global supply picture come more sharply into focus,” he said. “If we end up with a cold winter, things could get worse.”