Africa’s economy like the rest of the world continues to face prolonged depression due to the breakdown in much-needed commerce as a result of the ongoing Covid-19 pandemic.

Some countries have devalued their currencies in order to foster economic growth, but this has not done much good. A weakened currency gives rise to inflation and poor trading for major economic actors like exporters selling abroad and Importers (that is, firms selling imported goods)

Here are five currencies within the continent that have grown weaker compared to the US dollar.

Sao Tome and Principe Dobra (20817.44 STD – 1 Dollar)

The Sao Tome and Principe Dobra(STD) is currently the weakest currency in Africa. The country is the smallest on the continent.

The two-island state’s major revenue is gotten from the exportation of cocoa, coffee and coconut. However, this is hardly enough to sustain the local economy.

Sierra Leonean Leone (10317 Leone – 1 Dollar)

This is the second weakest currency on our list. Sierra Leonean Leone suffers from high inflation due to civil war and economic struggles. Struggle with the Ebola virus and the Covid-19 pandemic has further weakened the currency.

Guinean Franc (9802.21 GNF – 1 Dollar)

Guinea is one of the African countries with the most inflated currencies. The country’s currency is weak due to the high inflation rate, progressing poverty, and devalued currency.

Guinea should have been one of the countries with the most valuable currencies considering the country’s available natural resources. They include gold, diamonds, and aluminum. Guinea has the world’s largest bauxite reserves and is the biggest exporter of the ore.

Malagasy Ariary (3,775.77 MGA – 1 Dollar)

The currency keeps depreciating against the dollar due to the continuous high inflation rate.

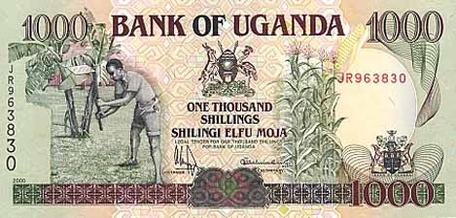

Ugandan Shilling (3530.300 Ugandan Shilling – 1 Dollar)

In August, the Bank of Uganda, the country’s central bank, indicated that the currency depreciated by 3 percent against the U.S. dollar in the first five months of 2020 due to increased outflows of investment following the Covid-19 pandemic.

**Currency exchange rates are available rates as of August 26, 2021. Slight changes occur as the weeks go by.